The “Buy Now, Pay Later” (BNPL) model has changed how people shop online. Instead of paying the full price upfront, consumers can split payments into smaller installments—often without interest. Klarna has become one of the most popular names in this space, serving more than 150 million active users across 45 countries (Statista, 2024).

But Klarna isn’t the only BNPL provider. Many shoppers and merchants are searching for apps like Klarna that offer more flexible plans, lower fees, or better regional coverage. With new players such as Affirm, Afterpay, Sezzle, Zip, and PayPal Pay Later, the competition is heating up, giving consumers more choice than ever before.

Contents

- 1 1. Why People Look for Apps Like Klarna

- 2 2. Top 5 Klarna Alternatives for Consumers

- 3 3. BNPL Market Trends 2026

- 4 4. Risks of Using BNPL Apps Like Klarna

- 5 5. Klarna Alternatives for Merchants & Businesses

- 6 6. Key Factors When Choosing Apps Like Klarna

- 7 7. Case Studies: Real Examples of Apps Like Klarna in Action

- 8 8. Beyond BNPL: The Rise of Crypto Payments with XaiGate

- 9 FAQs about Apps Like Klarna

- 10 Conclusion

1. Why People Look for Apps Like Klarna

Klarna is widely recognized, but it’s not perfect for everyone. There are several reasons why people explore Klarna alternatives:

Regional restrictions: Klarna is not available in every country, so shoppers in Asia, South America, or parts of Africa often look for alternatives like Zip or PayPal Pay Later.

Fee transparency: While Klarna offers interest-free installments, certain purchases may involve hidden fees or late penalties. Apps like Afterpay and Sezzle promote a clearer “no interest, no surprises” model.

Merchants seeking better deals: Businesses sometimes prefer competitors that offer lower transaction fees or faster settlement times, such as Affirm or PayPal Pay Later.

Higher credit flexibility: Some users want longer payment plans beyond the typical four installments. Affirm, for example, allows monthly payments spread over 3, 6, or 12 months, making it suitable for big-ticket items like electronics or travel.

Klarna is strong but not always the best fit. This is why demand for apps like Klarna continues to grow worldwide.

2. Top 5 Klarna Alternatives for Consumers

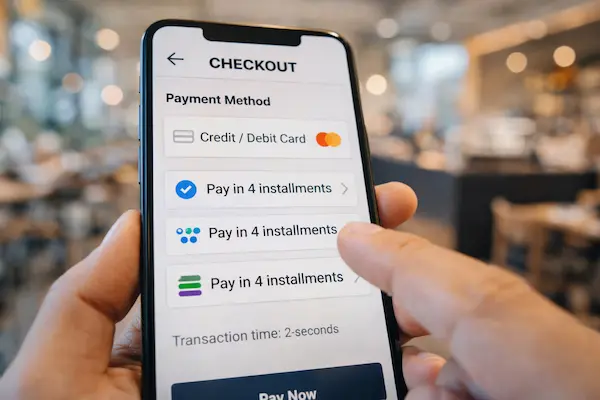

When people search for apps like Klarna, they often want flexibility and transparency. Here are five leading alternatives that stand out in 2026:

1. Affirm – Transparent Monthly Plans

Affirm is one of the biggest Klarna competitors in the U.S. Unlike traditional credit cards, Affirm lets users break down purchases into 3, 6, or 12-month installments. According to a 2024 report from PYMNTS.com, Affirm users are most active in electronics, furniture, and travel. The platform is known for its “no hidden fees” promise, meaning customers always know the total cost upfront.

2. Afterpay – Interest-Free Shopping

Afterpay has built a strong reputation among fashion and lifestyle brands. With over 20 million active users in the U.S., Australia, and the U.K., Afterpay makes it simple: pay in four equal, interest-free installments. This model is especially popular with Gen Z and Millennials, who prefer avoiding credit cards but still want flexibility when shopping for clothes, sneakers, and cosmetics.

3. Sezzle – Budget-Friendly & Flexible

Sezzle focuses on shoppers who want extra breathing room. It offers a standard “pay in four” plan, but also allows users to reschedule one payment per order for free. In 2023, Sezzle reported that over 90% of its users were under 35 years old, showing its popularity among younger, budget-conscious consumers.

4. Zip (formerly Quadpay) – Pay Anywhere

Unlike Klarna, which works only with partner merchants, Zip lets you split payments at any store that accepts Visa or Mastercard. This universal approach is a big draw for shoppers in countries where Klarna isn’t yet available. With operations in over 20 countries, Zip is quickly becoming one of the most flexible apps like Klarna for international users.

5. PayPal Pay Later – Trust & Global Reach

PayPal’s entry into the BNPL market is powerful because it builds on an already trusted brand. With over 400 million global users, PayPal Pay Later combines installment options with strong buyer protection. This makes it a top alternative for consumers who want both convenience and security. Many online retailers accept PayPal, which means the service often works seamlessly without any extra setup.

Table 1: Klarna vs Consumer BNPL Apps

| Feature | Klarna | Affirm | Afterpay | Sezzle | Zip | PayPal Pay Later |

|---|---|---|---|---|---|---|

| Installment Model | 4 or monthly | 3–12 months | 4 payments | 4–6 weeks | 4 payments | Monthly |

| Interest Fees | Sometimes | None/clear APR | None | None | None | May apply |

| Global Coverage | 45+ countries | U.S. only | 10+ countries | U.S., Canada | 20+ countries | Worldwide |

| Best For | Fashion, tech | High-value items | Everyday shopping | Budget users | Flexible use | Trusted global buyers |

3. BNPL Market Trends 2026

The demand for apps like Klarna is rising fast, driven by the global shift in consumer behavior. According to Statista, the number of Buy Now Pay Later (BNPL) users worldwide is projected to reach 1.5 billion by 2026, almost double compared to 2021.

Several important trends are shaping the BNPL market this year:

Explosive growth in Asia-Pacific: Countries like India, Indonesia, and Vietnam are seeing new local BNPL providers enter the market. While Klarna is still limited in these regions, Zip and PayPal Pay Later are expanding aggressively to capture demand.

Expansion into new industries: BNPL is no longer just for retail. In 2026, major players like Affirm and Klarna are pushing into travel bookings, healthcare payments, and subscription services. This makes them more attractive to consumers looking for flexible payment options beyond shopping.

Stricter regulations: Governments in the U.S., Australia, and the EU are implementing new transparency rules to protect consumers from hidden fees and debt risks. For shoppers, this means safer experiences; for merchants, it means choosing providers that comply with local laws.

Younger demographics leading adoption: A 2024 McKinsey survey found that over 60% of Gen Z and Millennials in the U.S. have used BNPL apps like Klarna or Afterpay at least once. This generation prefers installment-based payments over credit cards.

These trends show that the BNPL industry is still in rapid growth mode. Klarna remains influential, but competition from Affirm, Afterpay, Sezzle, Zip, and PayPal Pay Later is accelerating as consumer needs evolve.

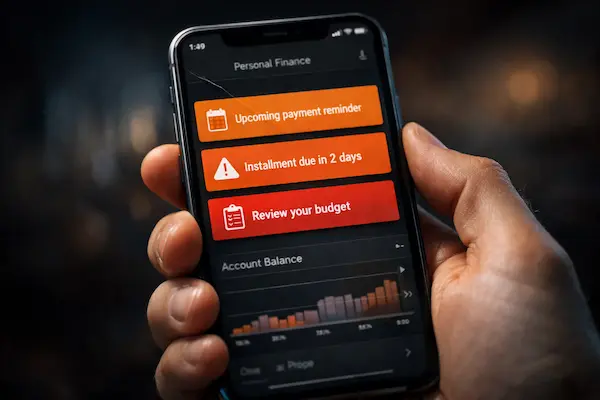

4. Risks of Using BNPL Apps Like Klarna

While apps like Klarna provide convenience and flexibility, they also come with potential downsides that shoppers should keep in mind:

1. Overspending and Impulse Buying

Because BNPL makes purchases feel “cheaper” by splitting them into smaller payments, many consumers end up buying more than they can realistically afford. A 2024 Consumer Financial Protection Bureau (CFPB) report in the U.S. found that over 30% of BNPL users spend beyond their monthly budget.

2. Late Fees and Penalties

Most apps like Klarna advertise “no interest,” but late or missed payments often trigger penalty fees. These fees can accumulate quickly, especially for younger users who don’t track due dates carefully.

3. Credit Score Impact

Some BNPL providers, including Affirm and Klarna, may report missed payments to credit bureaus. This means a few late payments could affect a user’s ability to qualify for loans, mortgages, or even credit cards.

4. Privacy and Data Concerns

BNPL companies collect a large amount of personal and financial data. While most are regulated, there are growing concerns about how this data is shared with merchants or used for targeted advertising. Regulators in the EU are pushing for stricter transparency rules in 2026.

5. Klarna Alternatives for Merchants & Businesses

BNPL is not just a consumer tool—it has become a powerful driver for online merchants. Retailers offering installment plans often see 20–30% higher conversion rates and larger average order values, according to a 2024 Worldpay Global Payments Report.

However, Klarna isn’t the only BNPL partner available. Many businesses explore apps like Klarna to find better fees, faster payouts, or easier integrations. Here are some of the strongest options for merchants in 2026:

1. Affirm Business – Deep Shopify Integration

Affirm partners closely with major e-commerce platforms like Shopify and Magento, making it easy for online stores to offer monthly installments. It’s especially popular among U.S. merchants selling high-value items such as electronics, travel, or furniture.

2. Afterpay for Merchants – Fashion & Lifestyle Focus

Afterpay is widely adopted in fashion e-commerce. Many clothing retailers in the U.S., UK, and Australia report higher sales when adding Afterpay as a checkout option. Its young, trend-driven user base makes it attractive to brands targeting Millennials and Gen Z.

3. Zip for Business – Global Reach with API Support

Zip offers flexible API and plugin integrations, which allow merchants to adapt BNPL across multiple platforms. It supports multi-currency transactions, making it a strong choice for businesses selling internationally.

4. PayPal Pay Later – Trust and Instant Settlement

Since many merchants already use PayPal, adding Pay Later is seamless. Funds usually settle instantly into PayPal accounts, improving cash flow compared to Klarna’s standard 2–3 day settlement period. For global businesses, PayPal also brings a higher level of trust.

Comparison Table 2: Klarna vs BNPL Merchant Solutions

| Provider | Merchant Fees | Integration Ease | Settlement Speed | Target Market |

|---|---|---|---|---|

| Klarna | ~2.9% + fees | Shopify, WooCommerce | 2–3 days | Global retail |

| Affirm | 2%–3% | Shopify, Magento | 1–2 days | U.S., high-value items |

| Afterpay | 4%–6% | Fashion platforms | 2–4 days | Apparel, lifestyle |

| Zip | 2%–4% | API + plugins | 1–3 days | Global merchants |

| PayPal Pay Later | 2.9% + $0.30 | Universal PayPal checkout | Instant | Worldwide |

Why This Matters for Merchants

For businesses, choosing between Klarna and its competitors often comes down to fees, speed, and target customers. For example, a U.S. furniture retailer may find Affirm better due to flexible long-term plans, while a global Shopify store might prefer PayPal Pay Later for faster settlement and brand trust.

6. Key Factors When Choosing Apps Like Klarna

With so many BNPL options available, choosing the right one depends on a few important factors:

Region Coverage – Klarna is strong in Europe and the U.S., but alternatives like Zip and PayPal Pay Later have better international availability.

Fee Structures – Some providers charge merchants higher fees (Afterpay), while others keep rates more transparent (Affirm). Consumers should also watch out for late fees.

Integration – Merchants should choose BNPL solutions that integrate smoothly with platforms like Shopify, WooCommerce, or Magento.

Trust & Brand Recognition – PayPal remains one of the most trusted payment brands globally, which can influence checkout conversion rates.

Credit Terms – If shoppers need longer plans (6–12 months), Affirm is usually better than Klarna or Afterpay.

While Klarna is a strong option, exploring apps like Klarna ensures you pick the one that best fits your budget, shopping style, or business needs.

7. Case Studies: Real Examples of Apps Like Klarna in Action

BNPL apps are not just theories—they’re driving real business results. By looking at actual case studies, we can see how apps like Klarna and its competitors help retailers boost sales, increase conversion rates, and expand globally. These stories show why BNPL continues to grow in 2026.

Case Study 1: Fashion Retailer Boosts Sales with Afterpay

A mid-sized online fashion store in Australia integrated Afterpay in late 2023. Within 6 months, the retailer reported a 25% increase in conversion rates and a 15% higher average order value (AOV) compared to customers who paid with traditional credit cards. Most users were Gen Z shoppers, who valued the “pay in 4, interest-free” model.

Case Study 2: U.S. Electronics Store Adopts Affirm

A consumer electronics retailer in California added Affirm to its checkout in early 2024. For big-ticket items like laptops and gaming consoles, customers preferred spreading costs over 6–12 months. As a result, sales of products over $1,000 grew by 30% year-over-year, while cart abandonment dropped significantly.

Case Study 3: Global Merchants Using PayPal Pay Later

An international SaaS company adopted PayPal Pay Later for its subscription services in Europe and Asia. Since many customers already trusted PayPal, adoption was fast. Within 3 months, 20% of new sign-ups came via BNPL, and churn rates dropped because users found monthly payments easier to manage.

Case Study 4: Zip Expands Reach in Emerging Markets

A Vietnamese cross-border e-commerce platform added Zip in 2026 to support shoppers in regions where Klarna isn’t available. Because Zip works anywhere Visa/Mastercard is accepted, it quickly became the preferred BNPL option for international customers, helping the business expand to over 10 new countries in under a year.

8. Beyond BNPL: The Rise of Crypto Payments with XaiGate

While apps like Klarna dominate the BNPL space today, the future of digital payments is moving even further—toward crypto-based transactions. Businesses worldwide are already exploring solutions like XaiGate, a secure and user-friendly crypto payment gateway, to accept BTC, BCH, USDT, USDC, DAI, and over 9,800 other cryptocurrencies.

For merchants, integrating BNPL options helps boost sales in the short term, but adding crypto payment acceptance positions them for the next wave of global commerce. With multi-network support (Ethereum, BSC, Tron, Solana) and transaction fees as low as 0.2%, XaiGate allows businesses to tap into a growing audience of crypto-native customers who value speed, security, and borderless payments.

In 2026 and beyond, the smartest retailers won’t just ask: “Which apps like Klarna should we use?” — they will also prepare for crypto adoption. Combining BNPL flexibility with XaiGate’s crypto gateway ensures businesses are ready for the future of global payments.

FAQs about Apps Like Klarna

1. Are apps like Klarna safe to use?

Yes. Most BNPL providers are regulated and use secure payment systems. Consumers should still read the terms carefully.

2. Do all BNPL apps charge interest?

No. Providers such as Afterpay, Sezzle, and Zip usually offer zero-interest installments, while Affirm may apply transparent APR on longer plans.

3. Can I use BNPL for travel bookings?

Yes. Klarna, Affirm, and Zip partner with airlines and travel agencies to let you book flights or hotels in installments.

4. What happens if I miss a payment?

Most apps charge a small late fee. Repeated missed payments can affect your credit score with some providers.

5. Which Klarna alternative has the widest global coverage?

PayPal Pay Later and Zip are the best options for international shoppers, as they work in multiple countries and with non-partner merchants.

6. Do merchants benefit from offering BNPL apps like Klarna?

Yes. Studies show retailers see 20–30% higher conversion rates and larger order values after adding BNPL options at checkout.

7. Do BNPL apps check credit scores?

Some do. Affirm and Klarna may run soft credit checks, while Afterpay and Sezzle generally don’t require them.

8. Are BNPL services expanding beyond retail?

Yes. In 2026, BNPL is expanding into travel, healthcare, and subscription services, making it more versatile for consumers.

Conclusion

The BNPL industry is growing faster than ever, and Klarna is no longer the only dominant name. Consumers and businesses now have multiple choices with apps like Klarna that provide different strengths—whether it’s Affirm’s longer monthly plans, Afterpay’s interest-free shopping, Sezzle’s flexibility, Zip’s global reach, or PayPal Pay Later’s trust factor.

In 2026, BNPL is expanding beyond retail into travel, healthcare, and subscriptions, while regulators in the U.S., EU, and Asia are pushing for greater transparency. This makes the market both exciting and safer for users. For merchants, offering BNPL has shifted from being an optional feature to a competitive necessity, with higher conversion rates and stronger customer loyalty.

Quick Takeaway – Best Apps Like Klarna in 2026

Affirm → Best for high-value purchases with long-term plans

Afterpay → Great for fashion and everyday shopping

Sezzle → Flexible rescheduling, budget-friendly

Zip → Works anywhere Visa/Mastercard is accepted

PayPal Pay Later → Trusted worldwide with instant settlements

Whether you’re a shopper looking for flexible payments or a merchant aiming to boost sales, exploring apps like Klarna ensures you get the right balance of convenience, security, and global coverage.

Ready to make smarter financial choices?

Compare Klarna with its top competitors today

Choose the BNPL solution that fits your lifestyle or business goals

Stay updated on BNPL trends in 2026 to get the best deals and avoid hidden risks

Start exploring now—and take control of how you shop, pay, and grow your business with the best Klarna alternatives.

For daily updates, subscribe to XAIGATE’s blog!

We may also be found on GitHub, and X (@mxaigate)! Follow us!